US GDP Forecasting#

Author: Dron Mongia

Course Project, UC Irvine, Math 10, S24

I would like to post my notebook on the course’s website: Yes

Motivation and Procedure#

GDP is a very strong metric of a country’s economic wellbeing and therefore, forecasts of GDP are highly sought after. Policy makers and legislators, for example, may want to have a rough forecast of the trends regarding the country’s GDP prior to passing some new bill or law. My procedure for this project will be to first compile time series data from the FRED api consisting of some economic metrics closely related to GDP (GDP = Consumption + Investment + Govt. Spending + Net Export). We then will conduct a series of exploratory tests to better understand our data, and finally we will use a vairety of models (including machine learning methods) to see which one provides the most accurate forecast.

import fredapi as fd

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import plotly.express as px

Feature Creation#

fred = fd.Fred(api_key = 'efdb939ff3f6b3129c564ef0aa34a91e') # generally this should be hidden, however for the purposes of this project I will keep it visible

def gen_df(category, series):

gen_ser = fred.get_series(series, frequency='q')

return pd.DataFrame({'Date': gen_ser.index, category + ' : Billions of dollars': gen_ser.values})

def merge_dataframes(dataframes, on_column):

merged_df = dataframes[0]

for df in dataframes[1:]:

merged_df = pd.merge(merged_df, df, on=on_column)

return merged_df

dataframes_list = [

gen_df('GDP', 'GDP'),

gen_df('PCE', 'PCE'),

gen_df('GPDI', 'GPDI'),

gen_df('NETEXP', 'NETEXP'),

gen_df('GovTotExp', 'W068RCQ027SBEA')

]

data = merge_dataframes(dataframes_list,'Date')

data

| Date | GDP : Billions of dollars | PCE : Billions of dollars | GPDI : Billions of dollars | NETEXP : Billions of dollars | GovTotExp : Billions of dollars | |

|---|---|---|---|---|---|---|

| 0 | 1960-01-01 | 542.648 | 326.4 | 96.476 | 2.858 | 144.233 |

| 1 | 1960-04-01 | 541.080 | 332.2 | 87.096 | 3.395 | 147.417 |

| 2 | 1960-07-01 | 545.604 | 332.1 | 86.377 | 4.682 | 150.459 |

| 3 | 1960-10-01 | 540.197 | 334.0 | 75.963 | 5.880 | 153.780 |

| 4 | 1961-01-01 | 545.018 | 334.5 | 78.378 | 5.902 | 157.254 |

| ... | ... | ... | ... | ... | ... | ... |

| 252 | 2023-01-01 | 26813.601 | 18269.6 | 4725.828 | -825.687 | 9326.383 |

| 253 | 2023-04-01 | 27063.012 | 18419.0 | 4780.290 | -806.093 | 9422.404 |

| 254 | 2023-07-01 | 27610.128 | 18679.5 | 4915.033 | -779.231 | 10007.677 |

| 255 | 2023-10-01 | 27956.998 | 18914.5 | 4954.426 | -783.734 | 9700.808 |

| 256 | 2024-01-01 | 28255.928 | 19164.2 | 5004.419 | -850.094 | 9924.229 |

257 rows × 6 columns

Date_col = data['Date'].tail(26) # to be used later on

print(Date_col)

231 2017-10-01

232 2018-01-01

233 2018-04-01

234 2018-07-01

235 2018-10-01

236 2019-01-01

237 2019-04-01

238 2019-07-01

239 2019-10-01

240 2020-01-01

241 2020-04-01

242 2020-07-01

243 2020-10-01

244 2021-01-01

245 2021-04-01

246 2021-07-01

247 2021-10-01

248 2022-01-01

249 2022-04-01

250 2022-07-01

251 2022-10-01

252 2023-01-01

253 2023-04-01

254 2023-07-01

255 2023-10-01

256 2024-01-01

Name: Date, dtype: datetime64[ns]

EDA#

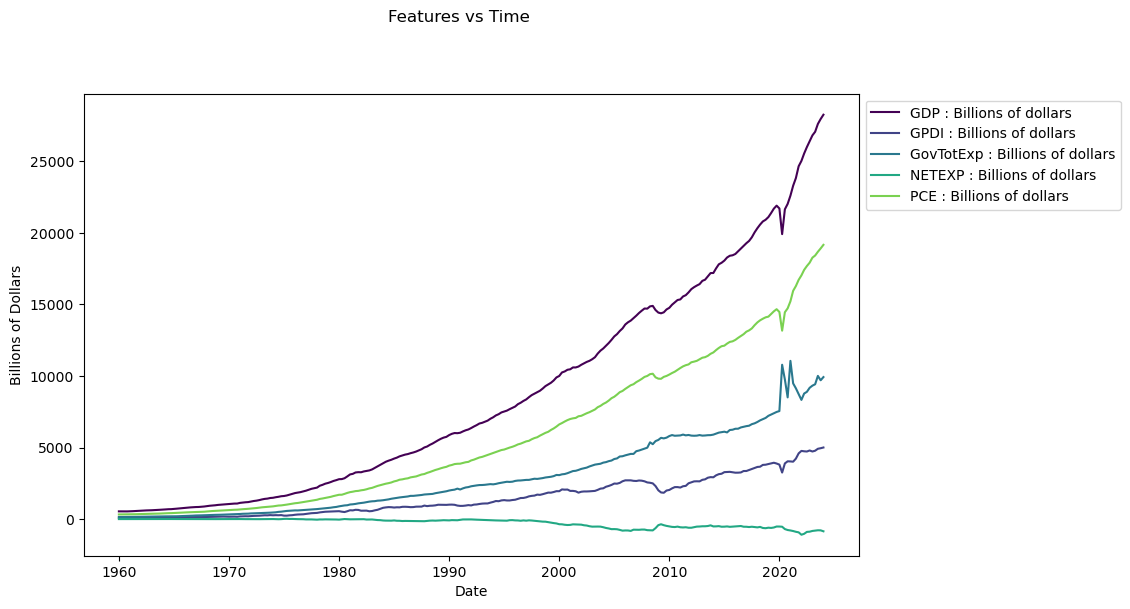

Below is a simple line plot comparing each of the time series. We notice that some of the features resemble GDP far more than others, however, we can not yet begin selecting and removing certain features prior do conducting more exploratory tests.

date_column = 'Date'

feature_columns = data.columns.difference([date_column])

fig, ax = plt.subplots(figsize=(10, 6))

fig.suptitle('Features vs Time', y=1.02)

for i, feature in enumerate(feature_columns):

ax.plot(data[date_column], data[feature], label=feature, color=plt.cm.viridis(i / len(feature_columns)))

ax.set_xlabel('Date')

ax.set_ylabel('Billions of Dollars')

ax.legend(loc='upper left', bbox_to_anchor=(1, 1))

# Show the plot

plt.show()

Here we run a test to evaluate the stationarity of out time series. Stationarity essentially means that a time series has a constant mean and varience. This is important to test for because many popular forecasting methods require stationarity to function properly. Although we can determine the stationarity for most of these time series just by looking at the graph, doing the testing is still beneficial because we will likely reuse it in later parts of the forecast.

from statsmodels.tsa.stattools import adfuller

for column in data.columns:

if column != 'Date':

result = adfuller(data[column])

print(f"ADF Statistic for {column}: {result[0]}")

print(f"P-value for {column}: {result[1]}")

print("Critical Values:")

for key, value in result[4].items():

print(f" {key}: {value}")

print("\n" + "=" * 40 + "\n")

ADF Statistic for GDP : Billions of dollars: 7.301049607594838

P-value for GDP : Billions of dollars: 1.0

Critical Values:

1%: -3.4562572510874396

5%: -2.8729420379793598

10%: -2.5728461399461744

========================================

ADF Statistic for PCE : Billions of dollars: 6.798336970342141

P-value for PCE : Billions of dollars: 1.0

Critical Values:

1%: -3.4562572510874396

5%: -2.8729420379793598

10%: -2.5728461399461744

========================================

ADF Statistic for GPDI : Billions of dollars: 2.765116699661126

P-value for GPDI : Billions of dollars: 1.0

Critical Values:

1%: -3.4561550092339512

5%: -2.8728972266578676

10%: -2.5728222369384763

========================================

ADF Statistic for NETEXP : Billions of dollars: -0.009808856906310032

P-value for NETEXP : Billions of dollars: 0.9577133440470131

Critical Values:

1%: -3.4565688966099373

5%: -2.8730786194395455

10%: -2.5729189953388762

========================================

ADF Statistic for GovTotExp : Billions of dollars: 2.7291557866089486

P-value for GovTotExp : Billions of dollars: 0.9990880001645039

Critical Values:

1%: -3.4577787098622674

5%: -2.873608704758507

10%: -2.573201765981991

========================================

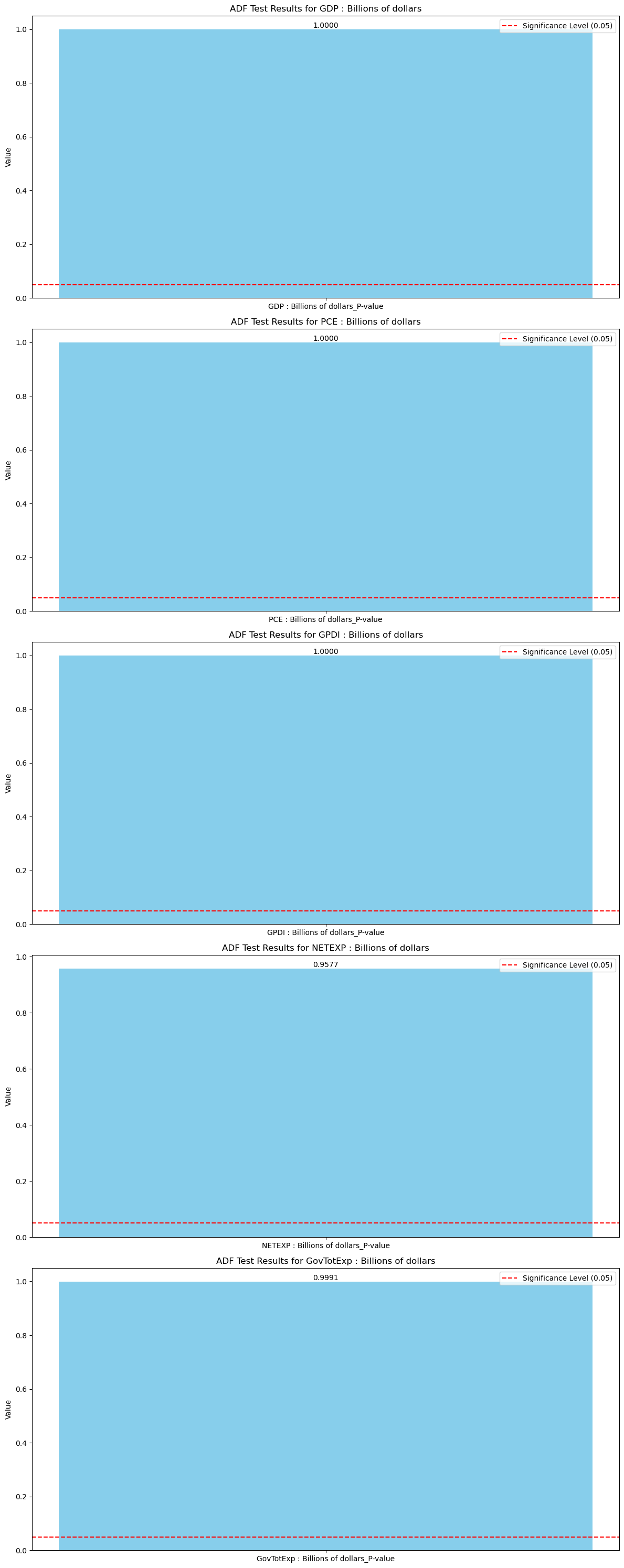

The numbers we are interested from this test are the P-values. A P-value close to zero (equal to or less than 0.05) implies stationarity while a value closer to 1 implies nonstationarity. We can see that all of our time series are highly unstationary due to their statistically insignificant p-values, in other words we are unable to reject the null hypothesis for stationarity. Below is a simple visual representation of the test. The red dotted line represents the P-value where we would be able to determine stationarity for the time series, the blue box represents the P-value where we are at currently.

adf_results = []

for column in data.columns:

if column != 'Date':

result = adfuller(data[column])

adf_results.append({

'Feature': column,

'ADF Statistic': result[0],

'P-value': result[1],

'Critical Values': result[4]

})

adf_df = pd.DataFrame(adf_results)

fig, axes = plt.subplots(nrows=len(adf_df), figsize=(12, 6 * len(adf_df)))

for idx, row in adf_df.iterrows():

ax = axes[idx] if len(adf_df) > 1 else axes

ax.bar(row['Feature'] + '_P-value', row['P-value'], color='skyblue')

ax.text(row['Feature'] + '_P-value', row['P-value'] + 0.005, f"{row['P-value']:.4f}", ha='center')

ax.set_title(f'ADF Test Results for {row["Feature"]}')

ax.set_ylabel('Value')

ax.axhline(y=0.05, color='red', linestyle='--', label='Significance Level (0.05)')

ax.legend()

plt.tight_layout()

plt.show()

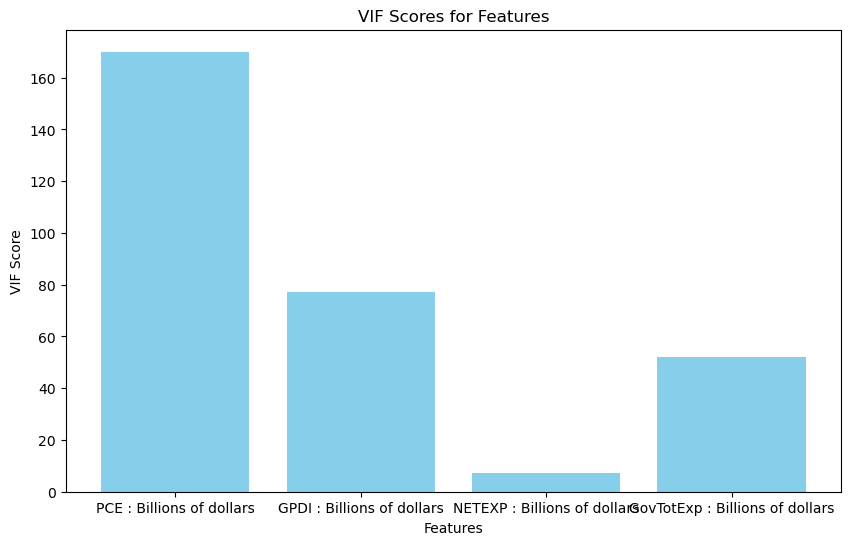

Below is a VIF (variance inflation factor) test. The purpose is to check for multicollinearity, or the degree of correlation the predictors share with one another. High multicollineaity is not necessairly detrimental for our forecast, however, it can make it much harder for us to determine the individual effect of each feature time series for the prediction, thus hurting the interpretability of the model. Usually a score less than 5 implies no multicollinearity, implying that our features are extremely higly correlated with one another. This will play into our model selection for later.

from statsmodels.stats.outliers_influence import variance_inflation_factor

X = data.iloc[:, [2, 3, 4, 5]]

X['intercept'] = 1

X = X[['intercept'] + [col for col in X if col != 'intercept']]

vif_data = pd.DataFrame()

vif_data["Feature"] = X.columns[1:]

vif_data["VIF"] = [variance_inflation_factor(X.values, i) for i in range(1, X.shape[1])]

print(vif_data)

plt.figure(figsize=(10, 6))

plt.bar(vif_data["Feature"], vif_data["VIF"], color='skyblue')

plt.title('VIF Scores for Features')

plt.xlabel('Features')

plt.ylabel('VIF Score')

plt.show()

C:\Users\Dronm\AppData\Local\Temp\ipykernel_49020\2334127177.py:5: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

X['intercept'] = 1

Feature VIF

0 PCE : Billions of dollars 170.028884

1 GPDI : Billions of dollars 77.277626

2 NETEXP : Billions of dollars 7.335556

3 GovTotExp : Billions of dollars 52.196119

Modeling#

VAR forecasting#

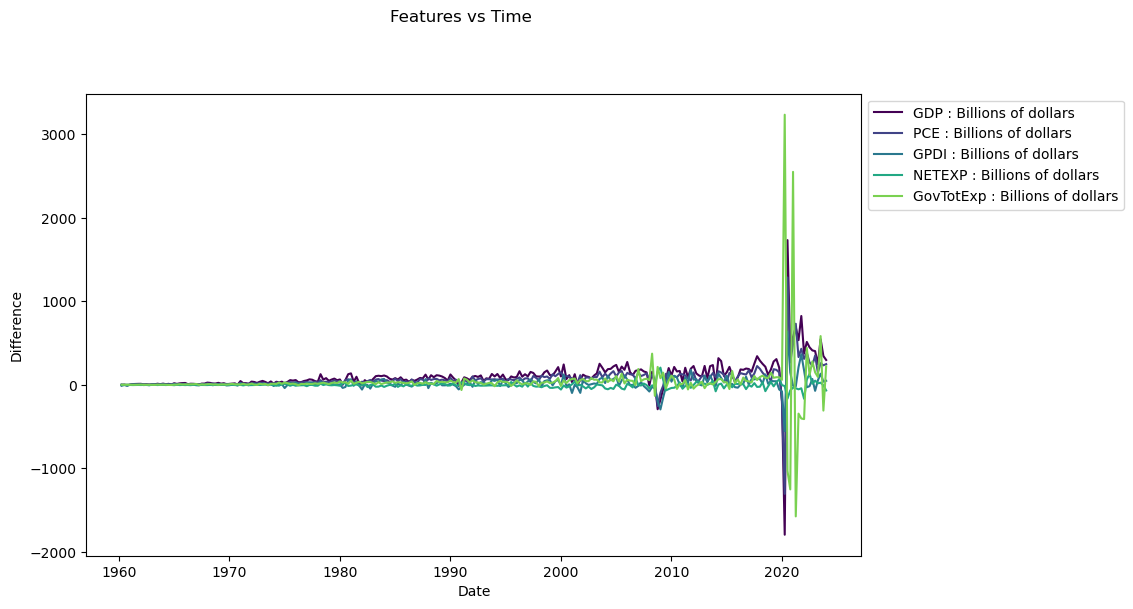

To use the Vector Auto Regression (VAR) model we need to first ensure our data is stationary. we can achieve this using a technique called differencing which essentially is a tranformation of the raw data. It is defined mathematically as y’(t) = y(t)-y(t-1). We are taking values from our time series and calculating the change which occured following the previous point.

data_diff = data.drop('Date', axis=1).diff().dropna()

for column in data_diff.columns:

result = adfuller(data_diff[column])

print(f"ADF Statistic for {column}: {result[0]}")

print(f"P-value for {column}: {result[1]}")

print("Critical Values:")

for key, value in result[4].items():

print(f" {key}: {value}")

print("\n" + "=" * 40 + "\n")

ADF Statistic for GDP : Billions of dollars: -3.906538294382316

P-value for GDP : Billions of dollars: 0.0019872523174590214

Critical Values:

1%: -3.4566744514553016

5%: -2.8731248767783426

10%: -2.5729436702592023

========================================

ADF Statistic for PCE : Billions of dollars: -6.0438368049790725

P-value for PCE : Billions of dollars: 1.3263283721705999e-07

Critical Values:

1%: -3.4564641849494113

5%: -2.873032730098417

10%: -2.572894516864816

========================================

ADF Statistic for GPDI : Billions of dollars: -14.67874111897741

P-value for GPDI : Billions of dollars: 3.180913951450319e-27

Critical Values:

1%: -3.4562572510874396

5%: -2.8729420379793598

10%: -2.5728461399461744

========================================

ADF Statistic for NETEXP : Billions of dollars: -8.837398948334888

P-value for NETEXP : Billions of dollars: 1.7044265762844e-14

Critical Values:

1%: -3.4565688966099373

5%: -2.8730786194395455

10%: -2.5729189953388762

========================================

ADF Statistic for GovTotExp : Billions of dollars: -3.110199822877988

P-value for GovTotExp : Billions of dollars: 0.0258075066297484

Critical Values:

1%: -3.4577787098622674

5%: -2.873608704758507

10%: -2.573201765981991

========================================

fig, ax = plt.subplots(figsize=(10, 6))

fig.suptitle('Features vs Time', y=1.02)

for i, feature in enumerate(data_diff.columns):

ax.plot(data['Date'][1:], data_diff[feature], label=feature, color=plt.cm.viridis(i / len(data_diff.columns)))

ax.set_xlabel('Date')

ax.set_ylabel('Difference')

ax.legend(loc='upper left', bbox_to_anchor=(1, 1))

# Show the plot

plt.show()

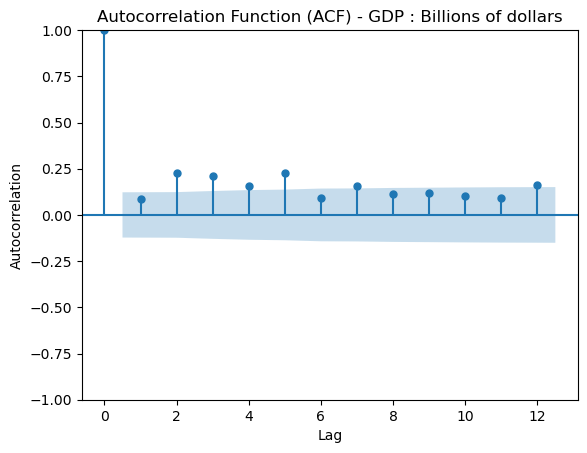

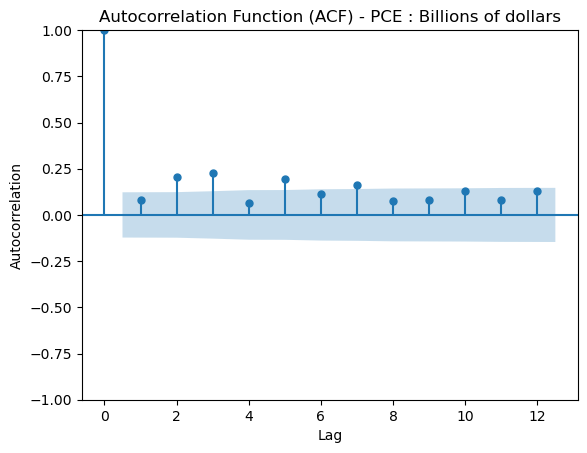

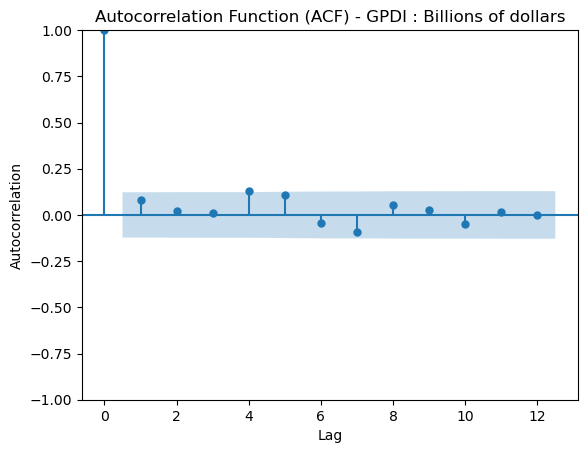

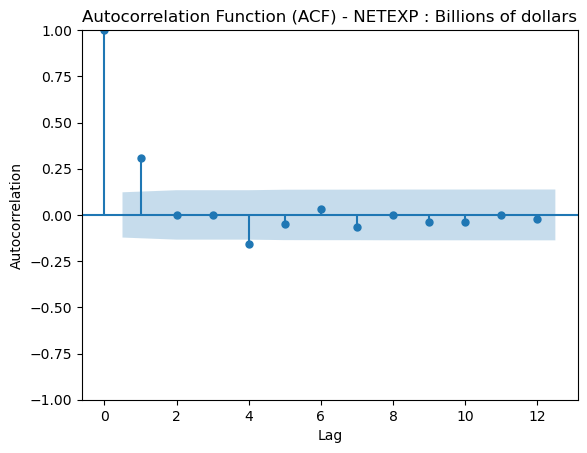

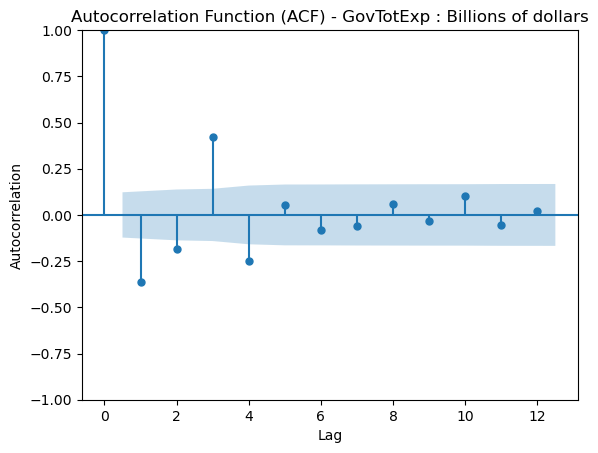

Below is an Autocorrelation Function (ACF) plot which tells us the significance that previous lags have to the current lag. This is usually helpful in evaluating factors like seasonality which are important for certain models. We can see that for the most part, previous lags have reasonably small scores in relation to our time series.

from statsmodels.graphics.tsaplots import plot_acf

for column in data_diff.columns:

if column != 'Date':

plot_acf(data_diff[column], lags=12)

plt.title(f'Autocorrelation Function (ACF) - {column}')

plt.xlabel('Lag')

plt.ylabel('Autocorrelation')

plt.show()

From the ADF test along with the plot we can determine that our data is now centered around the mean. Our next step is to perform a granger causality test which indicates to us if a lagged verison of a specific time series can help us predict out target time series, however not necessairly that one time series causes the other.

from statsmodels.tsa.stattools import grangercausalitytests

columns = ['PCE : Billions of dollars', 'GPDI : Billions of dollars', 'NETEXP : Billions of dollars', 'GovTotExp : Billions of dollars']

lags = [6, 9, 1, 1] #determined from individually testing each combination

for column, lag in zip(columns, lags):

df_new = data_diff[['GDP : Billions of dollars', column]]

print(f'For: {column}')

gc_res = grangercausalitytests(df_new, lag)

print("\n" + "=" * 40 + "\n")

For: PCE : Billions of dollars

Granger Causality

number of lags (no zero) 1

ssr based F test: F=0.8821 , p=0.3485 , df_denom=252, df_num=1

ssr based chi2 test: chi2=0.8926 , p=0.3448 , df=1

likelihood ratio test: chi2=0.8910 , p=0.3452 , df=1

parameter F test: F=0.8821 , p=0.3485 , df_denom=252, df_num=1

Granger Causality

number of lags (no zero) 2

ssr based F test: F=0.7486 , p=0.4741 , df_denom=249, df_num=2

ssr based chi2 test: chi2=1.5273 , p=0.4660 , df=2

likelihood ratio test: chi2=1.5228 , p=0.4670 , df=2

parameter F test: F=0.7486 , p=0.4741 , df_denom=249, df_num=2

Granger Causality

number of lags (no zero) 3

ssr based F test: F=0.9103 , p=0.4366 , df_denom=246, df_num=3

ssr based chi2 test: chi2=2.8087 , p=0.4221 , df=3

likelihood ratio test: chi2=2.7933 , p=0.4246 , df=3

parameter F test: F=0.9103 , p=0.4366 , df_denom=246, df_num=3

Granger Causality

number of lags (no zero) 4

ssr based F test: F=0.8554 , p=0.4914 , df_denom=243, df_num=4

ssr based chi2 test: chi2=3.5483 , p=0.4706 , df=4

likelihood ratio test: chi2=3.5235 , p=0.4743 , df=4

parameter F test: F=0.8554 , p=0.4914 , df_denom=243, df_num=4

Granger Causality

number of lags (no zero) 5

ssr based F test: F=1.8087 , p=0.1118 , df_denom=240, df_num=5

ssr based chi2 test: chi2=9.4578 , p=0.0921 , df=5

likelihood ratio test: chi2=9.2840 , p=0.0983 , df=5

parameter F test: F=1.8087 , p=0.1118 , df_denom=240, df_num=5

Granger Causality

number of lags (no zero) 6

ssr based F test: F=2.0385 , p=0.0614 , df_denom=237, df_num=6

ssr based chi2 test: chi2=12.9021 , p=0.0446 , df=6

likelihood ratio test: chi2=12.5802 , p=0.0502 , df=6

parameter F test: F=2.0385 , p=0.0614 , df_denom=237, df_num=6

========================================

For: GPDI : Billions of dollars

Granger Causality

number of lags (no zero) 1

ssr based F test: F=0.3612 , p=0.5484 , df_denom=252, df_num=1

ssr based chi2 test: chi2=0.3655 , p=0.5454 , df=1

likelihood ratio test: chi2=0.3653 , p=0.5456 , df=1

parameter F test: F=0.3612 , p=0.5484 , df_denom=252, df_num=1

Granger Causality

number of lags (no zero) 2

ssr based F test: F=0.0208 , p=0.9794 , df_denom=249, df_num=2

ssr based chi2 test: chi2=0.0425 , p=0.9790 , df=2

likelihood ratio test: chi2=0.0425 , p=0.9790 , df=2

parameter F test: F=0.0208 , p=0.9794 , df_denom=249, df_num=2

Granger Causality

number of lags (no zero) 3

ssr based F test: F=1.3069 , p=0.2727 , df_denom=246, df_num=3

ssr based chi2 test: chi2=4.0323 , p=0.2580 , df=3

likelihood ratio test: chi2=4.0005 , p=0.2614 , df=3

parameter F test: F=1.3069 , p=0.2727 , df_denom=246, df_num=3

Granger Causality

number of lags (no zero) 4

ssr based F test: F=1.0861 , p=0.3640 , df_denom=243, df_num=4

ssr based chi2 test: chi2=4.5051 , p=0.3419 , df=4

likelihood ratio test: chi2=4.4653 , p=0.3467 , df=4

parameter F test: F=1.0861 , p=0.3640 , df_denom=243, df_num=4

Granger Causality

number of lags (no zero) 5

ssr based F test: F=1.0364 , p=0.3968 , df_denom=240, df_num=5

ssr based chi2 test: chi2=5.4197 , p=0.3668 , df=5

likelihood ratio test: chi2=5.3620 , p=0.3733 , df=5

parameter F test: F=1.0364 , p=0.3968 , df_denom=240, df_num=5

Granger Causality

number of lags (no zero) 6

ssr based F test: F=1.0198 , p=0.4130 , df_denom=237, df_num=6

ssr based chi2 test: chi2=6.4546 , p=0.3742 , df=6

likelihood ratio test: chi2=6.3727 , p=0.3828 , df=6

parameter F test: F=1.0198 , p=0.4130 , df_denom=237, df_num=6

Granger Causality

number of lags (no zero) 7

ssr based F test: F=1.6969 , p=0.1105 , df_denom=234, df_num=7

ssr based chi2 test: chi2=12.6395 , p=0.0814 , df=7

likelihood ratio test: chi2=12.3291 , p=0.0902 , df=7

parameter F test: F=1.6969 , p=0.1105 , df_denom=234, df_num=7

Granger Causality

number of lags (no zero) 8

ssr based F test: F=1.8874 , p=0.0628 , df_denom=231, df_num=8

ssr based chi2 test: chi2=16.2107 , p=0.0395 , df=8

likelihood ratio test: chi2=15.7029 , p=0.0468 , df=8

parameter F test: F=1.8874 , p=0.0628 , df_denom=231, df_num=8

Granger Causality

number of lags (no zero) 9

ssr based F test: F=2.3202 , p=0.0162 , df_denom=228, df_num=9

ssr based chi2 test: chi2=22.6221 , p=0.0071 , df=9

likelihood ratio test: chi2=21.6454 , p=0.0101 , df=9

parameter F test: F=2.3202 , p=0.0162 , df_denom=228, df_num=9

========================================

For: NETEXP : Billions of dollars

Granger Causality

number of lags (no zero) 1

ssr based F test: F=9.1682 , p=0.0027 , df_denom=252, df_num=1

ssr based chi2 test: chi2=9.2773 , p=0.0023 , df=1

likelihood ratio test: chi2=9.1126 , p=0.0025 , df=1

parameter F test: F=9.1682 , p=0.0027 , df_denom=252, df_num=1

========================================

For: GovTotExp : Billions of dollars

Granger Causality

number of lags (no zero) 1

ssr based F test: F=57.2092 , p=0.0000 , df_denom=252, df_num=1

ssr based chi2 test: chi2=57.8903 , p=0.0000 , df=1

likelihood ratio test: chi2=52.1702 , p=0.0000 , df=1

parameter F test: F=57.2092 , p=0.0000 , df_denom=252, df_num=1

========================================

here we are just looking for a single lag for each feature which has statiscally significant p-values. Personal consumption Expenditures arguably did not make this cut off, however the sixth lag is so close that I decided to keep it in. Our next step is to create our VAR model now that we have decided that all of our features are significant.

from statsmodels.tsa.api import VAR

from sklearn.metrics import mean_absolute_error

columns = ['GDP : Billions of dollars', 'PCE : Billions of dollars', 'GPDI : Billions of dollars', 'NETEXP : Billions of dollars', 'GovTotExp : Billions of dollars']

data_diff = data_diff[columns]

split_index = int(len(data_diff) * 0.90)

train_data = data_diff.iloc[:split_index]

test_data = data_diff.iloc[split_index:]

model = VAR(train_data)

results = model.fit(maxlags=14)

forecast_steps = len(test_data)

forecast = results.forecast(train_data.values[-results.k_ar:], steps=forecast_steps)

forecast_df = pd.DataFrame(forecast, index=test_data.index, columns=columns)

gdp_forecast = forecast_df['GDP : Billions of dollars']

gdp_actual = test_data['GDP : Billions of dollars']

dates = data_diff.index[split_index:]

comparison_df = pd.DataFrame({'Date': Date_col, 'Actual GDP': gdp_actual.values, 'Forecasted GDP': gdp_forecast.values})

comparison_df.dropna(inplace=True)

mae = mean_absolute_error(comparison_df['Actual GDP'], comparison_df['Forecasted GDP'])

print(f"MAE: {mae:.2f}")

def mean_absolute_percentage_error(y_true, y_pred):

return np.mean(np.abs((y_true - y_pred) / y_true)) * 100

mape = mean_absolute_percentage_error(comparison_df['Actual GDP'], comparison_df['Forecasted GDP'])

print(f"MAPE: {mape:.2f}%")

print("GDP Actual vs Forecast:")

print(comparison_df)

plt.figure(figsize=(12, 6))

plt.plot(comparison_df['Date'], comparison_df['Actual GDP'], label='Actual GDP', color='blue')

plt.plot(comparison_df['Date'], comparison_df['Forecasted GDP'], label='Forecasted GDP', color='red', linestyle='--')

plt.xlabel('Date')

plt.ylabel('GDP : Billions of dollars')

plt.title('Actual vs Forecasted GDP using VAR')

plt.legend()

plt.show()

C:\Users\Dronm\anaconda3\Lib\site-packages\statsmodels\tsa\base\tsa_model.py:473: ValueWarning: An unsupported index was provided and will be ignored when e.g. forecasting.

self._init_dates(dates, freq)

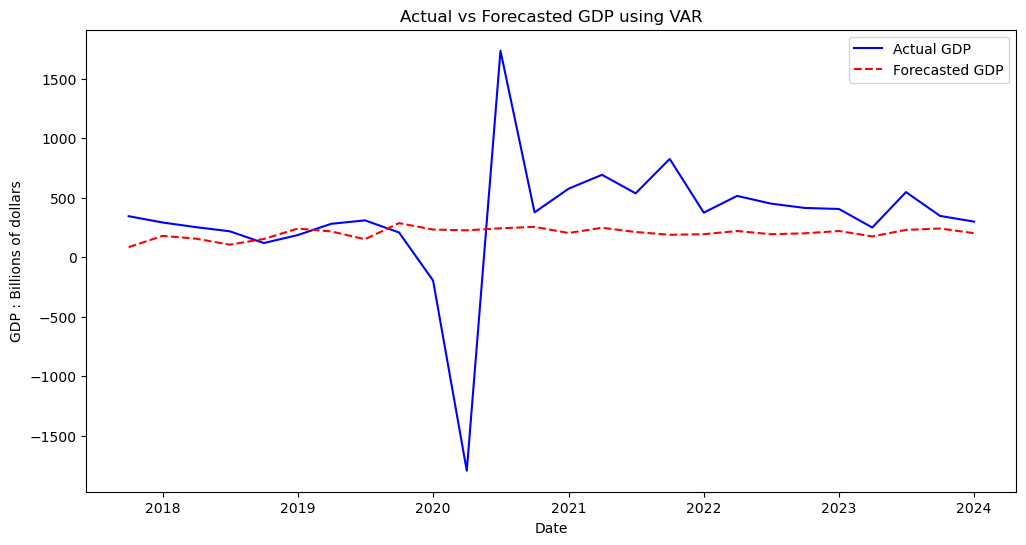

MAE: 328.39

MAPE: 57.72%

GDP Actual vs Forecast:

Date Actual GDP Forecasted GDP

231 2017-10-01 344.493 84.479946

232 2018-01-01 291.465 179.477634

233 2018-04-01 252.359 155.624087

234 2018-07-01 217.818 105.220413

235 2018-10-01 119.137 153.221441

236 2019-01-01 186.266 240.780124

237 2019-04-01 280.642 216.362075

238 2019-07-01 309.507 151.012279

239 2019-10-01 208.108 286.572411

240 2020-01-01 -195.877 232.309027

241 2020-04-01 -1793.370 226.008422

242 2020-07-01 1734.497 242.669525

243 2020-10-01 376.862 255.241138

244 2021-01-01 575.683 203.352525

245 2021-04-01 692.177 247.383534

246 2021-07-01 536.611 211.806723

247 2021-10-01 825.630 188.329785

248 2022-01-01 374.513 193.401142

249 2022-04-01 515.157 220.097723

250 2022-07-01 450.366 193.285245

251 2022-10-01 413.766 200.739952

252 2023-01-01 405.196 220.162682

253 2023-04-01 249.411 174.751380

254 2023-07-01 547.116 229.388535

255 2023-10-01 346.870 241.182963

256 2024-01-01 298.930 201.618804

Looking this forecast, we can clealy see that despite missing the mark quite heavily on both evaluation metrics used (MAE and MAPE), our model visually was not too innaccurate barring the outliers caused by the pandemic. We managed to stay on the testing line for the most part from 2018-2019 and from 2022-2024, however the global events following obviously threw in some unpredictability which affected the model’s ability to precisely judge the trends.

VECM forecasting#

VECM (Vector Error Correction Model) is similar to, albeit a few key differences. Unlike VAR, VECM does not rely on stationarity so differencing and normalizing the time series will not be necessary. Below is a Johansen cointegration test which conpares test values to critical values in order to determine the number of relevant cointegration relationships (variables which share a long term equilibrium relationship).

from statsmodels.tsa.vector_ar.vecm import VECM, select_order, select_coint_rank

columns = ['GDP : Billions of dollars', 'PCE : Billions of dollars', 'GPDI : Billions of dollars', 'NETEXP : Billions of dollars', 'GovTotExp : Billions of dollars']

data = data[columns]

rank_test = select_coint_rank(data, det_order=0, k_ar_diff=1)

print(rank_test.summary())

Johansen cointegration test using trace test statistic with 5% significance level

=====================================

r_0 r_1 test statistic critical value

-------------------------------------

0 5 243.6 69.82

1 5 94.27 47.85

2 5 47.34 29.80

3 5 15.06 15.49

-------------------------------------

columns = ['GDP : Billions of dollars', 'PCE : Billions of dollars', 'GPDI : Billions of dollars', 'NETEXP : Billions of dollars', 'GovTotExp : Billions of dollars']

data = data[columns]

split_index1 = int(len(data) * 0.90)

train_data1 = data.iloc[:split_index1]

test_data1 = data.iloc[split_index1:]

rank_test = select_coint_rank(data, det_order=0, k_ar_diff=1)

lag_order = select_order(data, maxlags=15, deterministic="ci")

model = VECM(train_data1, k_ar_diff=lag_order.aic, coint_rank=rank_test.rank, deterministic='ci')

results = model.fit()

forecast_steps = len(test_data1)

forecast = results.predict(steps=forecast_steps)

forecast_df = pd.DataFrame(forecast, index=test_data1.index, columns=columns)

gdp_forecast = forecast_df['GDP : Billions of dollars']

gdp_actual = test_data1['GDP : Billions of dollars']

dates = dates[:len(gdp_actual)]

comparison_df = pd.DataFrame({'Date': Date_col, 'Actual GDP': gdp_actual.values, 'Forecasted GDP': gdp_forecast.values})

comparison_df.dropna(inplace=True)

mae = mean_absolute_error(comparison_df['Actual GDP'], comparison_df['Forecasted GDP'])

print(f"MAE: {mae:.2f}")

print("GDP Actual vs Forecast:")

print(comparison_df)

plt.figure(figsize=(12, 6))

plt.plot(comparison_df['Date'], comparison_df['Actual GDP'], label='Actual GDP', color='blue')

plt.plot(comparison_df['Date'], comparison_df['Forecasted GDP'], label='Forecasted GDP', color='red', linestyle='--')

plt.xlabel('Date')

plt.ylabel('GDP : Billions of dollars')

plt.title('Actual vs Forecasted GDP using VECM')

plt.legend()

plt.show()

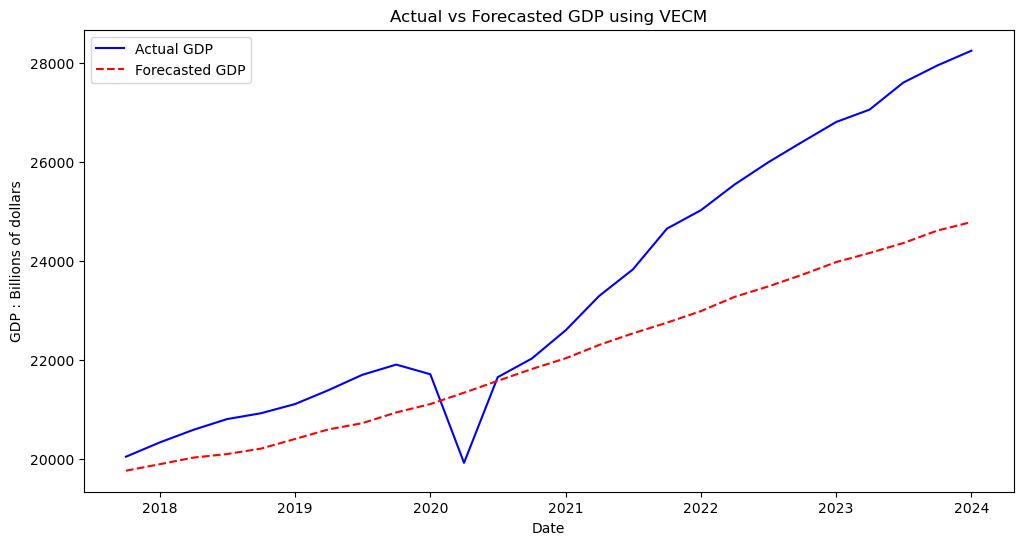

MAE: 1482.53

GDP Actual vs Forecast:

Date Actual GDP Forecasted GDP

231 2017-10-01 20037.088 19753.822655

232 2018-01-01 20328.553 19886.303817

233 2018-04-01 20580.912 20019.396912

234 2018-07-01 20798.730 20091.444369

235 2018-10-01 20917.867 20201.747583

236 2019-01-01 21104.133 20397.007183

237 2019-04-01 21384.775 20590.328595

238 2019-07-01 21694.282 20715.361432

239 2019-10-01 21902.390 20933.376095

240 2020-01-01 21706.513 21102.670722

241 2020-04-01 19913.143 21333.003367

242 2020-07-01 21647.640 21572.994781

243 2020-10-01 22024.502 21812.328621

244 2021-01-01 22600.185 22030.977990

245 2021-04-01 23292.362 22299.984264

246 2021-07-01 23828.973 22534.530745

247 2021-10-01 24654.603 22750.677701

248 2022-01-01 25029.116 22985.403756

249 2022-04-01 25544.273 23271.176604

250 2022-07-01 25994.639 23483.148023

251 2022-10-01 26408.405 23719.922245

252 2023-01-01 26813.601 23977.040794

253 2023-04-01 27063.012 24160.506343

254 2023-07-01 27610.128 24361.691614

255 2023-10-01 27956.998 24615.083068

256 2024-01-01 28255.928 24786.868614

Though it is hard to compare to our VAR model to this one given that we are now using the unstationary data, we can still deduce both by the error metric and the visualization that this model was not able to accurately capture the trends in this forecast. With this, it is fair to say that we can rule out traditional statistical methods for approaching this problem.

Machine Learning forecasting#

When deciding a machine learning approach to model this problem, I wanted to keep in mind the amount of data that I am working with. Prior to creating lagged columns, out dataset has a total of 1275 observations across all time series. This means that using more complex approaches, such as LSTMs or gradient boosting, are perhaps unnecessary as we can use more simple model to recieve the same amount of accuracy and far more interpretability.

def printevals(y_test,y_pred):

mape = mean_absolute_percentage_error(y_test, y_pred)

print(f"MAPE: {mape:.2f}%")

mae = mean_absolute_error(y_test, y_pred)

print(f"MAE: {mae:.2f}")

def plotresults(title):

comparison_df = pd.DataFrame({'Date': Date_col, 'Actual GDP': y_test.values, 'Forecasted GDP': y_pred})

comparison_df.dropna(inplace=True)

print("GDP Actual vs Forecast:")

print(comparison_df)

plt.figure(figsize=(12, 6))

plt.plot(comparison_df['Date'], comparison_df['Actual GDP'], label='Actual GDP', color='blue')

plt.plot(comparison_df['Date'], comparison_df['Forecasted GDP'], label='Forecasted GDP', color='red', linestyle='--')

plt.xlabel('Date')

plt.ylabel('GDP : Billions of dollars')

plt.title(title)

plt.legend()

plt.show()

Train-Test Split#

Train-test splits for time series problems differ slightly from splits in traditional regression or classification tasks. Here it is imparative that we do not shuffle around our data, since that would mean we are training our model on data from the future which in turn will cause data leakages. Also notice that we are training over a very large portion (90%) of the data. This is because we are not actually concerned with forecasting over a large time frame. Realistically even forecasting over several years is not probable for this task. (Note we also used the train test split in our VAR and VECM models, it just felt more appropriate to talk about in the Machine Learning section)

split_index = int(len(data_diff) * 0.90)

train_data = data_diff.iloc[:split_index]

test_data = data_diff.iloc[split_index:]

X_train = train_data.drop('GDP : Billions of dollars', axis=1)

y_train = train_data['GDP : Billions of dollars']

X_test = test_data.drop('GDP : Billions of dollars', axis=1)

y_test = test_data['GDP : Billions of dollars']

Random Forests#

Remembering our VIF test from earlier, we know our features are highly multicolinear. This partially plays into the decision of choosing random forests as our model. decision trees make binary choices between features, meaning that theoretically our features being highly correlated should not be detrimental to our model. In addition to this, random forests is generally a very strong model being robust to overfitting from the schocastic nature of how the trees are computed and generally being very simple to implement.

from sklearn.ensemble import RandomForestRegressor

rf_model = RandomForestRegressor(n_estimators=100, random_state=42)

rf_model.fit(X_train, y_train)

y_pred = rf_model.predict(X_test)

printevals(y_test,y_pred)

plotresults('Actual vs Forecasted GDP using Random Forest')

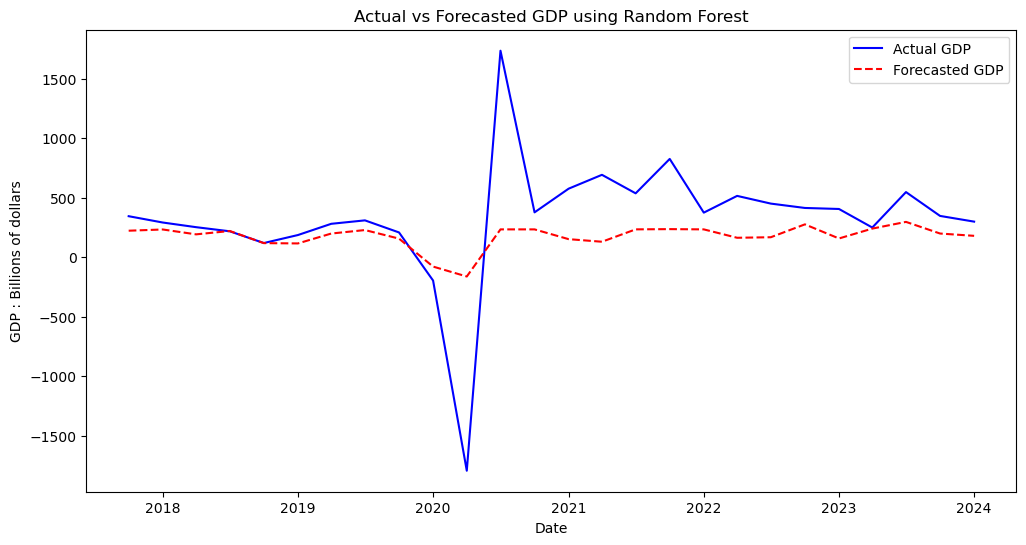

MAPE: 44.31%

MAE: 287.97

GDP Actual vs Forecast:

Date Actual GDP Forecasted GDP

231 2017-10-01 344.493 222.66964

232 2018-01-01 291.465 232.99618

233 2018-04-01 252.359 192.05078

234 2018-07-01 217.818 220.23716

235 2018-10-01 119.137 118.40956

236 2019-01-01 186.266 115.82722

237 2019-04-01 280.642 198.88359

238 2019-07-01 309.507 228.12818

239 2019-10-01 208.108 156.30033

240 2020-01-01 -195.877 -78.69897

241 2020-04-01 -1793.370 -161.98572

242 2020-07-01 1734.497 233.81564

243 2020-10-01 376.862 233.81564

244 2021-01-01 575.683 151.72623

245 2021-04-01 692.177 129.98664

246 2021-07-01 536.611 233.97176

247 2021-10-01 825.630 235.97884

248 2022-01-01 374.513 233.81564

249 2022-04-01 515.157 163.32067

250 2022-07-01 450.366 167.84568

251 2022-10-01 413.766 275.92276

252 2023-01-01 405.196 157.41253

253 2023-04-01 249.411 240.37866

254 2023-07-01 547.116 296.78346

255 2023-10-01 346.870 198.98305

256 2024-01-01 298.930 179.61721

We can see that Random Forests was able to produce our best forecast yet, attaining better error metrics than our attepts at VAR and VECM. Perhaps most impressively, visually we can see that our model was almost perfectly encaptualiting the data from 2017-2019, just prior to encountering the outliers.

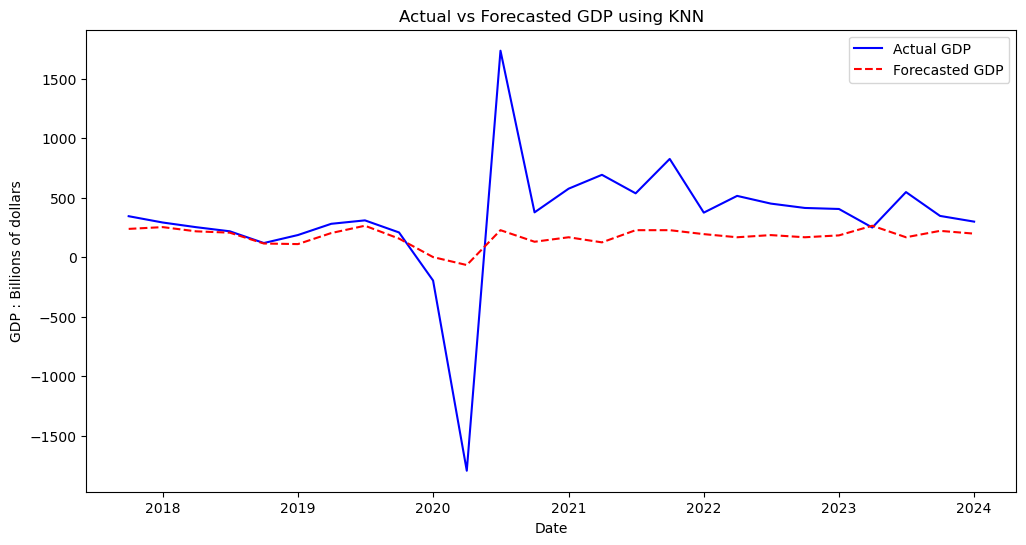

KNN#

KNN (K-Nearest-Neighbors) was one final apporach I wanted to attempt. Given that our data is fairly low dimensional (5 features), with over 1000 observations, we have a ratio which should allow this algorithm to perform very well. Notice below we test out various values of our hyperparamter k, with k=2 seemingly being the best one.

from sklearn.neighbors import KNeighborsRegressor

for i in range (1,10):

knn_model = KNeighborsRegressor(n_neighbors=i)

knn_model.fit(X_train, y_train)

y_pred = knn_model.predict(X_test)

print(f'for k = {i} ')

printevals(y_test,y_pred)

print("\n" + "=" * 40 + "\n")

for k = 1

MAPE: 48.93%

MAE: 302.74

========================================

for k = 2

MAPE: 47.72%

MAE: 303.45

========================================

for k = 3

MAPE: 48.31%

MAE: 306.37

========================================

for k = 4

MAPE: 48.41%

MAE: 306.15

========================================

for k = 5

MAPE: 49.35%

MAE: 310.94

========================================

for k = 6

MAPE: 50.54%

MAE: 315.49

========================================

for k = 7

MAPE: 50.36%

MAE: 315.71

========================================

for k = 8

MAPE: 50.62%

MAE: 317.13

========================================

for k = 9

MAPE: 50.04%

MAE: 315.95

========================================

knn_model = KNeighborsRegressor(n_neighbors=2)

knn_model.fit(X_train, y_train)

y_pred = knn_model.predict(X_test)

printevals(y_test,y_pred)

plotresults('Actual vs Forecasted GDP using KNN')

MAPE: 47.72%

MAE: 303.45

GDP Actual vs Forecast:

Date Actual GDP Forecasted GDP

231 2017-10-01 344.493 237.9050

232 2018-01-01 291.465 252.8530

233 2018-04-01 252.359 217.4445

234 2018-07-01 217.818 206.1615

235 2018-10-01 119.137 115.1375

236 2019-01-01 186.266 110.2265

237 2019-04-01 280.642 203.0175

238 2019-07-01 309.507 264.4540

239 2019-10-01 208.108 156.4880

240 2020-01-01 -195.877 1.0515

241 2020-04-01 -1793.370 -65.8135

242 2020-07-01 1734.497 227.1580

243 2020-10-01 376.862 129.9220

244 2021-01-01 575.683 167.6270

245 2021-04-01 692.177 124.7765

246 2021-07-01 536.611 227.1580

247 2021-10-01 825.630 227.1580

248 2022-01-01 374.513 193.9800

249 2022-04-01 515.157 167.6270

250 2022-07-01 450.366 185.8210

251 2022-10-01 413.766 167.6270

252 2023-01-01 405.196 183.3980

253 2023-04-01 249.411 264.4540

254 2023-07-01 547.116 167.6270

255 2023-10-01 346.870 221.4005

256 2024-01-01 298.930 198.0385

We can see KNN in its own right performed very well. Despite being out performed slightly in terms of error metrics compared to Random Forests, visually the model performed about the same and arguably captured the period before the pandemic from 2018-2019 even better than Random Forests.

Conclusions#

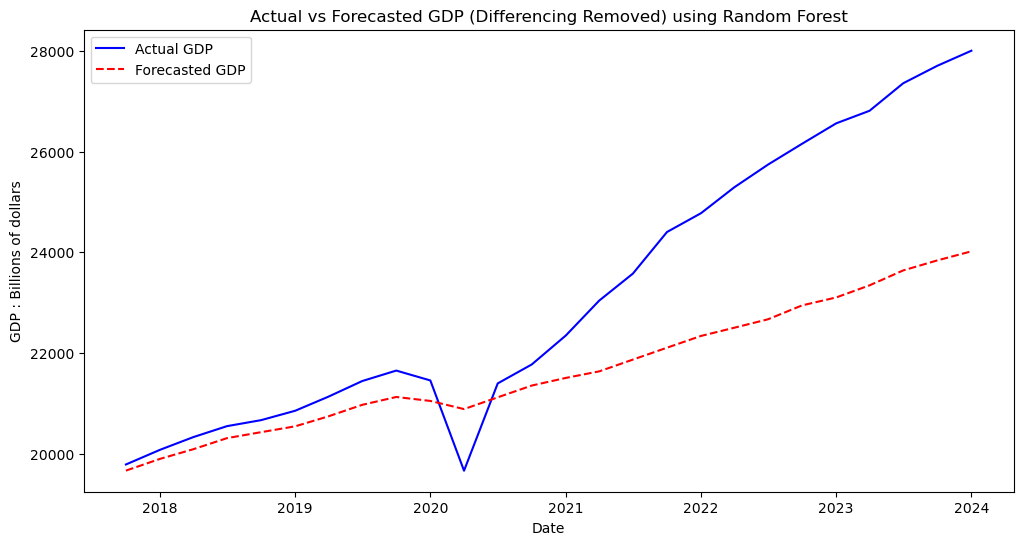

Looking at all of our models, we can see the one which performed the best was Random Forests. This is most likely due to Random Forests generally being a very strong predictive model which can be fit to a vairety of datasets. In general the machine learning algorithms far outperformed the traditional statistical methods. Perhaps this can be explained by the fact that VAR and VECM both require a great amount of historical background data to work optimally, something which we did not have much of given that our data came out in quarterly intervals. There also may be something to be said about how both the machine learning models used were nonparametric. These models often are governed by less assumptions than their counterparts and therefore may be more flexible to unique problem sets like the one here. Below is our final best prediction, removing the differencing transformation we previously used to fit the models.

rf_model = RandomForestRegressor(n_estimators=100, random_state=42)

rf_model.fit(X_train, y_train)

y_pred = rf_model.predict(X_test)

comparison_df = pd.DataFrame({'Date': Date_col, 'Actual GDP': y_test.values, 'Forecasted GDP': y_pred})

comparison_df.dropna(inplace=True)

last_actual_value = data.iloc[split_index - 1]['GDP : Billions of dollars']

comparison_df['Actual GDP'] = comparison_df['Actual GDP'].cumsum() + last_actual_value

comparison_df['Forecasted GDP'] = comparison_df['Forecasted GDP'].cumsum() + last_actual_value

plt.figure(figsize=(12, 6))

plt.plot(comparison_df['Date'], comparison_df['Actual GDP'], label='Actual GDP', color='blue')

plt.plot(comparison_df['Date'], comparison_df['Forecasted GDP'], label='Forecasted GDP', color='red', linestyle='--')

plt.xlabel('Date')

plt.ylabel('GDP : Billions of dollars')

plt.title('Actual vs Forecasted GDP (Differencing Removed) using Random Forest')

plt.legend()

plt.show()

Challenges and Areas of Improvement#

By far the greatest challenge regarding this forecasting problem was handeling the massive outlier caused by the pandemic along with the following instability caused by it. Our methods for forecasting obviously can not predict that this would occur, ultimately decreasing our accuracy for each approach. Had our goal been to forecast the previous decade, our models would most likely have a much easier time finding and predicting trends. In terms of improvement and further research, I think a possible solution would be to perform some sort of normalization and outlier smoothing technique on the time interval from 2020-2024, and then evaluating our fully trained model on new quarterly data which comes in. In addition, it may be beneficial to incorporate new features which have a heavy influence on GDP such as quarterly inflation and personal assest evaluations.

References#

For traditional statistical methods - https://link.springer.com/book/10.1007/978-1-4842-7150-6 For machine learning methods - https://www.statlearning.com/